CCH TAGETIK EBA用于FINREP,COREP,资产担保,资金计划和Almm合规性的监督报告软件。

通过一个解决方案将多个法规的复杂性降至最低。CCH Tagetik EBA监督报告已预先打包有银行需要满足FINREP,COREP,资产抵押,资金规划和ALMM要求以进行更多披露的监管合规工具。通过使用符合EBA的数据自动填充报告模板,财务不受监管报告的影响。CCH Tagetik的自动化解决方案承担了工作量,因此您可以轻松地按时完成工作。

为了减少重大错误的风险,CCH Tagetik提供了端到端的流程和数据治理。工作流程管理流程,审核日志可防止将少量查询转变为冗长的调查。从数据收集到最终披露,您可以放心使用CCH Tagetik。

CCH Tagetik EBA监督报告协助您更专注于业务的3个原因

加快合规

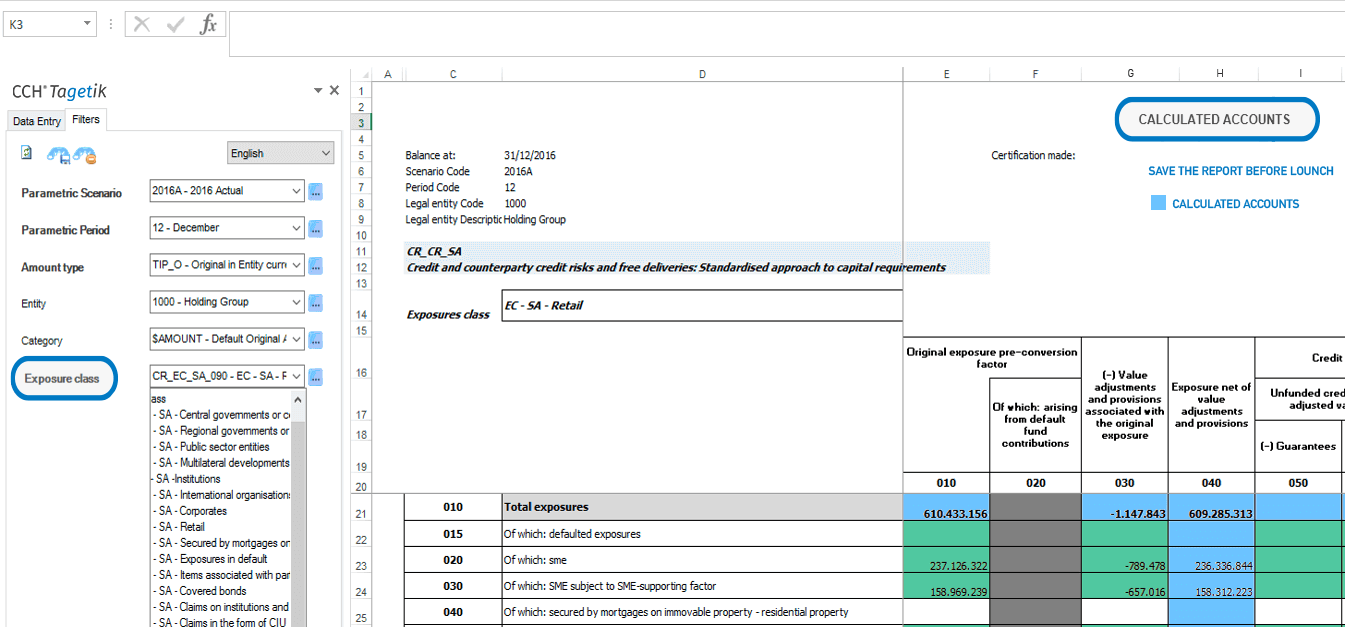

我们的解决方案已预先打包了一套完整的帐户,预建的FINREP和COREP模板,诊断检查,计算规则,合并逻辑,multi-GAAP支持和XBRL输出。

容易扩展

我们知道没有两家银行是一样的。为了满足您的独特需求,您可以使用财务友好的界面为CCH Tagetik配置单独的会计科目表,报告或其他自定义图表,而无需编码。

自动化的数据质量和工作流程

从数据收集到披露,保持数据完整性。我们的图形化工作流程将指导您完成报告,同时进行自动验证检查,以确保数据符合FINREP和COREP规则。

EBA监督报告

从数据收集到最终披露,再到监管机构,CCH Tagetik EBA监督报告均具有解决FINREP和COREP合规性所需的所有功能,财务智能和流程治理。

- 确保控制、诊断和验证的准确性

- 自动将数据级联到预先构建的模板中

- 工作流程可指导您从数据收集到批准

- 与我们公司间座舱进行和解与匹配

- 灵活的配置可满足您的特定要求

主要优势

CCH Tagetik的EBA监督报告解决方案与所有数据源和现有应用程序无缝集成,因此您拥有一个适用于所有财务绩效管理流程的平台。始终保持最新状态,我们将通过定期维护使您的解决方案与不断变化的EBA法规保持一致。

- 快速实施预置的解决方案

- 轻松映射来自多个来源的数据

- 使FINREP和COREP数据与IFRS报告一致

- 与所有贡献者合作

- 使利益相关者就唯一结果达成一致

其他信息

What is an encumbrance?: Before we get to asset encumbrance, we must first understand the definition of an “encumbrance.” Encumbrance is a promise to spend money in the future for a specific purpose.

What is asset encumbrance?: The definition of asset encumbrance means different things to different job functions.

What does encumbrance mean in finance?: In finance, encumbrance refers to the controls accounting systems use to prevent overspending. Encumbrances determine the purpose of funds before organizations have spent any money or made a purchase.

What does encumbrance mean in accounting?: In accounting, asset encumbrance refers to restricted funds that are reserved for a specific liability.

What does encumbrance mean in banking?: Asset encumbrance is the process banks go through to secure or collateralize a claim. Banks must specify assets that creditors can take possession of if the bank fails to meet its commitments. If a borrower defaults, the lender can liquidate the asset to recover their cash. Asset encumbrance is also known as pledging or earmarking.

Where does asset encumbrance occur?: Asset encumbrance occurs in transactions that are asset-backed. Some examples of this are market funding, insurance claims, repurchase agreements, securitizations, covered bonds, or derivatives.

What is FINREP?: The meaning of “FINREP” itself is “Financial Reporting.” The European Economic Area (EEA) and the European Banking Authority (EBA) requires banks to create FINREP reports. Enacted September 30, 2014, FINREP increased the amount of information banks had to disclose in their financial reports. Specifically, the income statement and balance sheet must now highlight more granular data from the general ledger. In addition, FINREP requires banks to submit quarterly reports that contain a whopping 40+ forms/templates and 3,500 data fields.

What are the objectives of FINREP?: FINREP’s objective, summarized by PWC, is as follows: 1) Standardize reporting: To standardize reporting requirements across Europe in order to reduce the impact of multiple regular reporting requirements from different European supervisors; 2) Central repository: Establish a central repository for European banking data to enable improved risk identification and management for cross-border institutions; 3) Enable analysis: Facilitate peer reviews, trend predictions, risk analysis and provide greater transparency, especially on cross-border institutions; 4) Data Sharing: Enable data to be easily shared with national and international authorities, supervisory colleges, ESRB and ESAs.

Who is affected by FINREP?: FINREP applies to credit institutions, banks and investment firms that are listed on a stock exchange, prepare IFRS compliant financial statements, and are subject to CRD IV.

Why was FINREP introduced?: To promote greater transparency, the EEA and the EBA wanted to harmonize European banks and investment companies. The solution? They introduced the Capital Requirements Directive IV (CRD IV) which came into effect January 1st, 2014. The regulation requires two reports: Common Reporting (COREP) and Financial Reporting (FINREP).

What is ALMM reporting (EBA)?: The European Banking Authority (EBA) issued a set of reports, including FINREP and COREP, which fall under the category of supervisory reports. These supervisory reports handle the recognition and reporting forms for financial companies, banks, securities, investment companies and other financial intermediaries referred to in Article 107 of Legislative Decree 385/93. The supervisory statistical reporting takes a closer look at the consolidated data of balance sheets and income statements, registered from information on individual companies belonging to the banking group. The reports require additional data relating to credit quality, securitization, life remaining derivative contracts, infra-group reports. Additional information relating to prudential supervision of heritage, solvency ratio, large risks, market risks, and the position international investment is also needed. Regulatory reporting is one of the means through which the financial institution controlling entities analyze the financial situation of the institution.

How does ALMM reporting (EBA) apply to the banking business?: For the banking business, the international regulatory standards are defined by the Basel Committee on Banking Supervision. This standardization body edicts guidelines on reports that banks have to provide their supervisory body. The latest set of guidelines is called Basel II and is currently enforced by the supervisory bodies. The general guidelines are adapted to each country via Country Specific Adjustments. For the insurance business, the solvency accord has instituted similar guidelines. Generally, these guidelines are oriented around: 1) ensuring sound financial practices; 2) ensuring the level of capital of the financial institutions covers the level of risk taken; 3) including correlation between various kinds of risk. They tend to ensure that in case the risks faced by the institution realized themselves the institution has the required available funds to cover the losses.

What is COREP (EBA)?: Together, the European Economic Area (EEA) and the European Banking Authority (EBA) wanted to ensure better financial transparency and harmonize European banks and investment companies. They introduced the Capital Requirements Directive IV (CRD IV) which came into effect January 1st 2014. The regulation requires two reports: Common Reporting (COREP) and Financial Reporting (FINREP). COREP’s goal is to increase transparency in regulatory reports and standardize requirements for capital and risk. It does this by requiring reporting entities to disclose granular data, especially in terms of credit risk, market risk, operational risk, own funds and capital adequacy ratios. According to PWC, COREP impacts members of the European banking industry in four areas: 1) COREP standardizes reporting requirements across Europe: prior to its implementation, there were multiple reporting requirements from different supervising authorities 2) A central repository for banking data: a central repository promises to improve the understanding, management and identification of risk for entities that cross borders 3) Enable analysis: by standardising information, it is easier to predict trends, conduct peer reviews, analyze risk and see an apples to apples view of banking institutions 4) Data sharing: a templated version of data requirements from a central repository allows more effective sharing with authorities, supervisory colleges, ESRB and ESAs

What is COREP (EBA) for banking businesses?: 1) Group Solvency/Large Exposures; 2) Market Risk; 3) Capital Adequacy; 4) Credit Risk; 5) Operational Risk.

EBA监督报告 相关资源

如何在银行中实现财务合并、管理和监管报告的卓越表现。高层管理人员访谈

受需求启发的渐进式CFO

联合信贷集团实施了CCH Tagetik的软件解决方案,用于合并、管理、法定及监管报告,预算和预测

相关解决方案

或 跳转到应用与市场

借助CCH Tagetik,我们可以在单个应用程序中满足IFRS和FINREP的要求,同时为整个集团的各种任务建立灵活的框架。易于使用的解决方案可以最佳地指导用户完成组合并,管理报告和法定报告的过程。由于它现在可以快速响应新的外部需求和内部临时询问,因此我们为将来做好了准备。

Barbara Kainz

集团合并总监 at ERSTE集团

我们认为CCH Tagetik [和实施伙伴] pmOne不仅将我们理解为财务专业人员,而且还将我们理解为财务服务专业人员。顾问们完全知道FINREP和Basel III的含义。这为我们快速实施该项目奠定了坚实的基础。